28+ Debt payment plan calculator

The credit cards have 0 interest. Earned Income Tax Credit.

Hp Fyju7nxsadm

The net effect is just one extra mortgage payment per year but the interest savings can be dramatic.

. Youll also shorten your payment term to 24 years and 6 months. For example if you have a 250 monthly car payment and 50 minimum credit card payment your monthly debt would be 300. I plan to retire at the end of next year with 25000 in credit card debt and 15 more years to pay my mortgage.

10 of discretionary income never more than under Standard Plan. The payment limit terms are usually 42 days but with no contract between the parties payment must be made within 28 days of the request. Lenders prefer your max front-end ratio to be 28 or lower but if youre following our plan your total housing costs shouldnt be more than 25 of your take-home pay.

The multiple debt calculator will create a single payment schedule that gives you a personalized step-by-step plan to reduce and then eliminate debt. According to this example if you choose a bi-weekly payment plan and pay an extra 50 every pay period youll save 41128 on total interest charges. A back-end ratio includes your monthly housing costs plus any other monthly debt payments you have like credit cards student loans or medical bills.

Preliminary estimates based on information you enter and such factors as current interest rates credit score and a debt-to-income ratio DTI above 43 may yield different pricing results. Nov 28 2022. These are recurring monthly expenses like car payments minimum credit card payments or student loans.

Home Mortgage Interest on up to 750000 of mortgage debt. Student Loan Interest Paid. The Federal Trade Commission notes that if you make a payment or agree to payment arrangements in certain states the debt is revived.

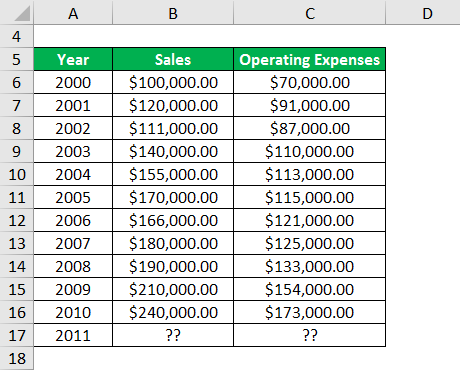

The IBR plan not only bases your payment on your income but also promises loan forgiveness. How To Calculate Your Front End Debt-To-Income Ratio DTI. Just plug in the amount of the.

According to the Australian Payment Times Reporting Bill of 2020 all companies must have a turnover of more than 100 million dollars for them to report on the payment practices and terms for small. To qualify for loan forgiveness you must make on-time payments for 20 years for loans disbursed after July 1. 1 2007 with partial financial hardship.

Back end ratio looks at your non-mortgage debt percentage and it should be less than 36 percent if you are seeking a loan or line of credit. Even if you pay the entire debt off it may not be removed from your credit report. Borrowers will be making an additional payment with a bi-weekly payment plan than the normal monthly payment.

I have a good medical benefit when I retire and. 10 or 15 of discretionary income never more than under Standard plan. If you have too much debt and too little income to pay off your student loans the Income-Based Repayment plan can help prevent default.

That means the statute of limitations is reset allowing the collector to legally sue you for the remainder of the debt. The 2836 rule is a good starting point to create your house-hunting budget but be sure to take into account all of your expenses and the size of your down payment. Meanwhile if you have a bi-weekly payment schedule and pay an extra 200 on every pay period youll save 75092.

As a rule of thumb lenders are looking for a front ratio of 28 percent or less. On August 28 the IRS issued. The calculator can give you an idea of your expected tax savings for each individual year and for the total time you plan to stay in your home.

Do not underestimate the one extra payment a year for your mortgage because it can save you thousands of. Break down your monthly budget and understand exactly how much money is left over to put toward a home loan that you can consistently meet without breaking a sweat. Pay As You Earn PAYE 20 years.

Use this calculator to figure how much interest you can save by making 12 of your mortgage payment every two weeks instead of a full payment monthly. Use this free Texas Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. A mortgage calculator can be an extremely handy tool to help plan.

Direct Loan borrower after Oct. Partial financial hardship or standard loan payments exceed 10 of discretionary income. The debt will be paid off in 48 months while following the loan consolidation method it will be paid off in 28 months selecting this option will show the total value of the current payments.

You can adjust this amount in our affordability calculator as needed. Estimate your monthly payment with our free mortgage calculator and apply today.

Free Debt Snowball Spreadsheets Forms Calculators Excel Word Pdf Best Collections

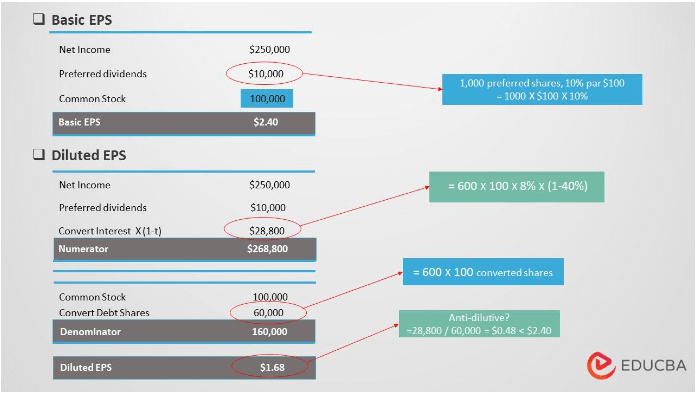

Diluted Eps Earnings Per Share Meaning Formula Examples

Stock Beta Explanation And Example Of Stock Beta With Excel Template

Tables To Calculate Loan Amortization Schedule Free Business Templates

Hp Fyju7nxsadm

45 Best Startup Budget Templates Free Business Legal Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

45 Best Startup Budget Templates Free Business Legal Templates

45 Best Startup Budget Templates Free Business Legal Templates

Payslip Templates 28 Free Printable Excel Word Formats Business Template Templates Professional Templates

Example Of Hs Gradebook Google Search School Report Card Report Card Template Homeschool High School

Total Debt Service Ratio Explanation And Examples With Excel Template

45 Best Startup Budget Templates Free Business Legal Templates

Total Debt Service Ratio Explanation And Examples With Excel Template

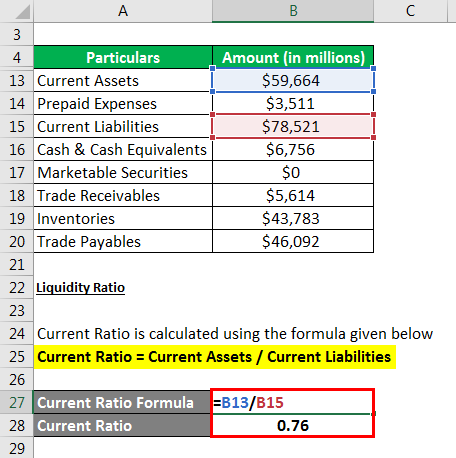

Accounting Ratio Formula Complete Guide On Accounting Ratio Formula

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates